Market Size of China's Aluminum Doors, Windows, and Curtain Wall Processing Equipment Industry

Driven by dual-carbon policies, urbanization, and the smart manufacturing wave, the aluminum door, window, and curtain wall industry is evolving toward green energy efficiency and intelligent high-end solutions.

Correspondingly, its processing equipment is developing toward greater intelligence and precision. The following provides a detailed analysis:Development Trends in Aluminum Doors, Windows, and Curtain WallsGreen Energy Efficiency as Core Focus: The deepening implementation of the dual-carbon strategy is driving the industry to prioritize energy-saving upgrades. Leading manufacturers now offer ultra-low-energy aluminum doors and windows with thermal transmittance coefficients far exceeding national standards. Products like triple-chamber aluminum windows and high-airtightness curtain walls address insulation needs in northern cold regions and typhoon resistance/heat insulation demands in southern areas.

Simultaneously, the industry is further reducing product energy consumption through R&D in new materials like composite aluminum alloys and improved insulating glass. The penetration rate of energy-efficient aluminum doors and windows in high-end buildings is projected to rise from the current 30% to over 50%.Smart Integration and Functional Upgrades: Smart curtain wall systems and intelligent doors/windows have become market focal points. These products integrate smart sensing and automatic adjustment capabilities—for instance, sensors detect light and temperature to automatically regulate sash opening/closing and sunshade angles. Some high-end commercial buildings also combine curtain walls with BIM technology for intelligent facade management and maintenance.

Additionally, security features in doors/windows are continuously enhanced, with integrated applications.

Driven by dual-carbon policies, urbanization, and the smart manufacturing wave, the aluminum door, window, and curtain wall industry is evolving toward green energy efficiency and intelligent high-end solutions. Correspondingly, its processing equipment is developing toward greater intelligence and precision. Below is a detailed analysis:

Development Trends in Aluminum Doors, Windows, and Curtain Walls

Green Energy Efficiency as Core Focus: The deepening implementation of the dual-carbon strategy is driving the industry to prioritize energy-saving upgrades. Leading manufacturers now offer ultra-low-energy aluminum doors and windows with thermal transmittance coefficients far exceeding national standards. Products like triple-chamber aluminum windows and high-airtightness curtain walls address insulation needs in northern cold regions and typhoon resistance/heat insulation demands in southern areas. Simultaneously, the industry is further reducing product energy consumption through R&D in new materials like composite aluminum alloys and improved insulating glass. The penetration rate of energy-efficient aluminum doors and windows in high-end buildings is projected to rise from the current 30% to over 50%.

Smart Integration and Functional Upgrades: Smart curtain wall systems and intelligent doors/windows have become market focal points. These products integrate smart sensing and automatic adjustment capabilities—for instance, sensors detect light and temperature to automatically regulate sash opening/closing and sunshade angles. Some high-end commercial buildings also combine curtain walls with BIM technology for intelligent facade management and maintenance. Additionally, security features in doors/windows are continuously enhanced, with integrated applications like fingerprint recognition and remote monitoring becoming increasingly common.

Market Concentration Toward High-End Segments with Pronounced Regional Differentiation: Industry competition is gradually consolidating. Leading enterprises leverage technological and scale advantages to expand market share through mergers and acquisitions, while small and medium-sized enterprises face significant pressure due to homogenized competition. Regionally, coastal areas like East and South China focus on high-end energy-efficient, wind-resistant, and waterproof products—for instance, Shenzhen mandates 100% green buildings for new constructions. Central and western regions, driven by accelerated urbanization, release demand for mid-range and economical products, maintaining annual growth rates above 10%. Simultaneously, domestic products leverage the Belt and Road Initiative to expand overseas, with export value projected to grow at an average annual rate of 6%.

Product customization adapts to diverse needs: Differing functional requirements across scenarios drive customization trends. Commercial complexes prioritize aesthetic appeal and daylighting, often employing large-span unitized curtain walls; high-end residences emphasize sound insulation, thermal performance, and privacy, frequently featuring high-performance system doors and windows; coastal buildings require specialized typhoon-resistant and corrosion-proof curtain walls. Customization services have become a key competitive lever for enterprises.

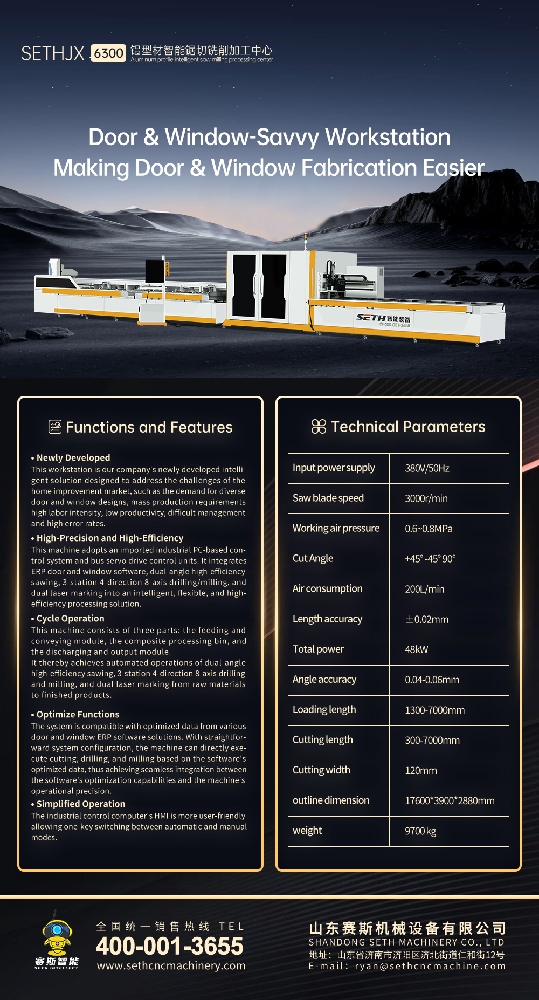

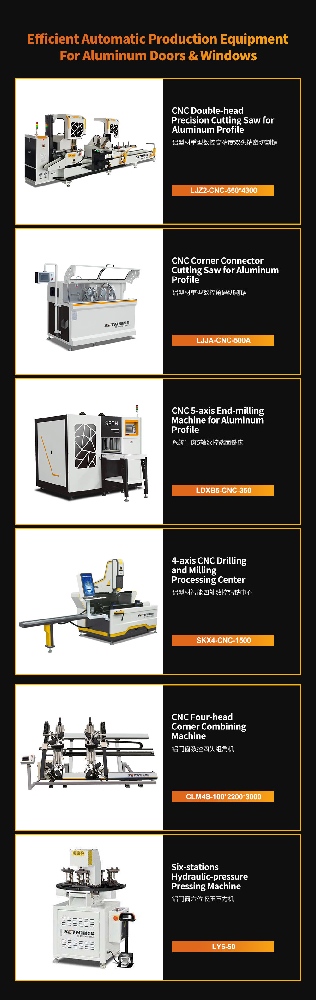

Development Trends in Aluminum Door/Window Curtain Wall Processing Equipment

Deep Integration of Intelligence and Automation: Policy initiatives are driving continuous increases in equipment intelligence upgrade rates. On one hand, the adoption of advanced equipment like laser cutting and CNC punching has significantly risen. Paired with intelligent interlinking systems, these enable automated multi-process production. On the other hand, equipment is progressively integrated into digital workshop systems, achieving seamless connectivity with CAD/CAM systems. This facilitates data collaboration from design to processing, reducing manual intervention. Simultaneously, the establishment of remote operation and maintenance platforms enables enterprises to monitor equipment status in real time, promptly troubleshoot issues, and enhance production efficiency. Companies like Jinan Tianchen are expanding their production capacity for such high-end intelligent equipment.

Combining High Precision with Low Energy Consumption: Increasing demands for processing accuracy in aluminum doors, windows, and curtain walls are driving equipment upgrades toward higher precision. For instance, error control in precision sawing and automatic punching equipment continues to shrink to accommodate complex product design requirements. Furthermore, driven by energy efficiency policies, equipment manufacturers are optimizing core components and refining operational processes to reduce energy consumption. The 2025 energy efficiency improvement target for building materials processing equipment is set at no less than 15%. Future equipment will further balance high-precision processing with low-energy operation.

Modularization and Integration Enhance Flexible Production Capabilities: To accommodate customized production demands, processing equipment is trending toward modular design. Individual machines can rapidly switch processing tasks by replacing modules, accommodating diverse specifications and styles of aluminum doors, windows, and curtain walls. Simultaneously, multi-process integrated machining centers are proliferating, consolidating operations like cutting, drilling, and milling. This reduces process transition time and material waste, significantly boosting production efficiency while supporting small-batch, high-frequency production models.

Domestic Substitution Accelerates with Core Technology Breakthroughs: While high-end servo systems and other components still rely on imports, domestic substitution is accelerating. The self-sufficiency rate for key components is projected to rise above 65% within the next three years. Leading domestic enterprises are not only expanding high-end equipment production capacity but also focusing on core technological breakthroughs like CNC system integration. Patent applications in the industry grew by 13.8% year-on-year in 2024. Additionally, equipment manufacturers are actively expanding into overseas markets, securing more orders in regions like Southeast Asia and the Middle East by leveraging their cost-performance advantages.